To encourage revitalization of historic downtown, the City of San Angelo offers incentives for development in the Downtown Historic District.

The incentives are part of an overall strategy to leverage investment, lower the cost of doing business and level the playing field for businesses and property owners choosing to invest in downtown properties.

Unless specifically exempted, all projects seeking incentives must meet current building standards, codes and permitting requirements as well as be current on all taxing obligations. Projects seeking incentives are encouraged to apply for, if eligible, Historic Overlay Zoning (HOZ). Approval for HOZ is not required to receive incentives. All incentives are subject to funding availability, final approval by the City of San Angelo and, depending on the project, may be more than provided for herein.

Tax Abatement Policy

An abatement of City property taxes on real property may be granted as part of a Tax Increment Reinvestment Zone project when the proposed rehabilitation and/or improvement(s) increase the value of the existing real property by a minimum of fifty (50) percent.

The abatement will be calculated on the appraised value of improvements as follows:

| Projects exceeding $25,000 in construction and design* costs | |||||

|---|---|---|---|---|---|

| YEAR | 1 | 2 | 3 | 4 | 5 |

| REBATE | 100% | 90% | 80% | 70% | 60% |

*Design fees will only be included in the abatement if a registered architect has designed the project.

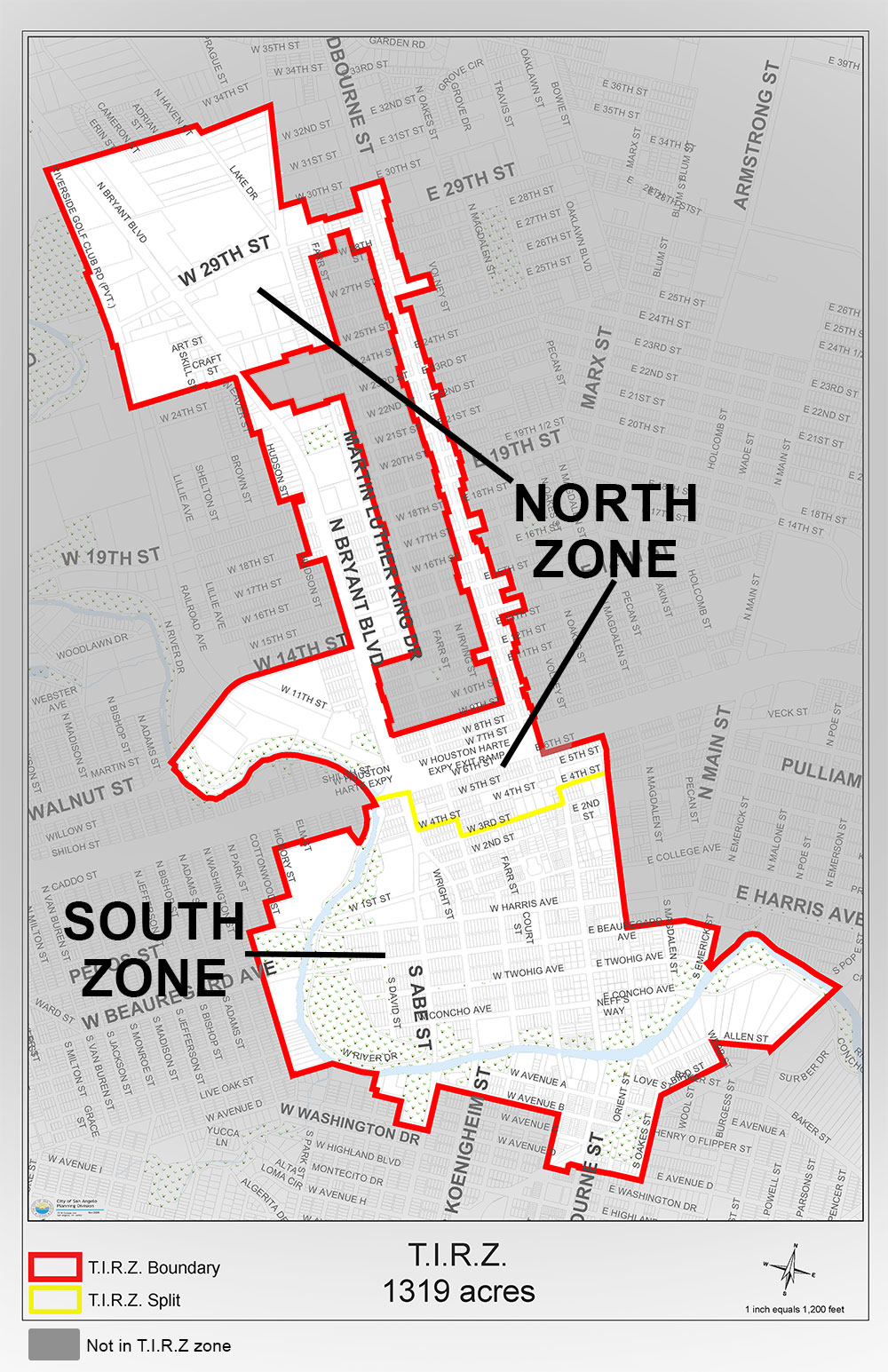

Tax Increment Reinvestment Zone Incentive Program

To encourage revitalization and infill development of properties which fall within the Tax Increment Reinvestment Zone (TIRZ), the City of San Angelo offers incentives for projects that improve properties and bring new business to the area. The incentive types offered by this program include façade improvement, historic preservation, landscape installation, screening of outdoor storage, paving (only as part of a larger project), secondary egress required by the Fire Code, asbestos abatement, and installation of a fire sprinkler system or monitored smoke alarm system. For qualified projects, this program can also offer sales tax rebates on locally purchased construction materials and property tax abatement as noted above. Finally, reduction of development fees may also be included in an incentive package.

This program provides reimbursement grants and is a very competitive program. Typically applications are accepted twice per year, depending on funding availability. Projects are reviewed by City staff and the TIRZ Board, who make a recommendation to the City Council who has final approval authority.

North & South Applicants may drop off completed applications to the Downtown San Angelo, Inc. office at 24 W Concho Ave between the hours of 9am-5pm.

Learn more about TIRZ: https://www.cosatx.us/departments-services/development-services/tax-increment-reinvestment-zone-board

Historic Rehabilitation Tax Credits

The National Park Service administers this program. The tax incentives promote the rehabilitation of historic structures of every period, size, style and type. Through the program, abandoned or under used schools, warehouses, factories, churches, retail stores, apartments, hotels, houses, and offices throughout the country have been restored to life in a manner that maintains their historic character.

Current tax incentives for preservation, established by the Tax Reform Act of 1986 (PL 99-514; Internal Revenue Code Section 47 [formerly Section 48(g)]) include:

20% tax credit for the certified rehabilitation of certified historic structures.

10% tax credit for the rehabilitation of non-historic, non-residential buildings built before 1936.

A tax credit differs from an income tax deduction. An income tax deduction lowers the amount of income subject to taxation. A tax credit, however, lowers the amount of tax owed. In general, a dollar of tax credit reduces the amount of income tax owed by one dollar.

The 20% rehabilitation tax credit equals 20% of the amount spent in a certified rehabilitation of a certified historic structure.

The 10% rehabilitation tax credit equals 10% of the amount spent to rehabilitate a non-historic building built before 1936.The National Development Council (NDC), through a joint contract with the San Angelo Development Corporation and the City of San Angelo, provides ongoing advice and assistance to any building owner wishing to take advantage of the historic rehab tax credits.

Main Street Design Assistance

San Angelo was designated a Texas Main Street City by the Texas Historical Commission (THC) in 2005. One benefit of this designation is free architectural design assistance provided by the design staff of the THC’s Main Street Program. Property owners within the Main Street district benefit from architectural services for rehabilitating storefronts, entire buildings, sign design and conducting building maintenance projects on historic structures. Services generally include on-site visits, architectural renderings, color selection and other design assistance related to building rehabilitation. These services are coordinated through the Downtown San Angelo, Inc. office.

Other Incentives Available

San Angelo Development Corporation (SADC) Incentives: SADC was created by San Angelo voters who approved an additional ½ cent local sales tax to (1) facilitate the development of new businesses and expansion of existing businesses which create primary jobs, (2) provide for infrastructure necessary to promote or develop new or expanded business enterprises, (3) develop the San Angelo Business & Industrial Center and (4) develop, implement, provide, and finance certain voter approved community projects.

Financial assistance may be provided through the following:

Grants

Loan participation(s) with local financial institutions

Grow San Angelo Fund: This fund is a partnership between the San Angelo Development Corporation and the Grow America Fund, Inc. (GAF). The Grow San Angelo Fund is an SBA 7(a) guaranty program administered by the National Development Council (NDC). NDC is one of the nation’s oldest not-for-profit corporations specializing in community, economic and public facility development. The Grow San Angelo fund is designed to help small businesses within the City of San Angelo obtain the financing required to grow their business. GSA will look to finance healthy, successful small businesses that need expansion capital. For complete information about SADC incentive programs, see Appendix A & B.

Code Benefits for Downtown Development

International Existing Building Code:The City of San Angelo has adopted the International Existing Building Code, a developer-friendly code that allows for improvements that consider the design limitations of older buildings to encourage adaptive reuse by allowing different levels of modification to existing structures.

Contact

Michael Dane

Interim Director of Economic Development

(325) 653-7197

michael.dane@cosatx.us

Rick Weise

Assistant City Manager

(325) 657-4241

rick.weise@cosatx.us